International Real Estate

Arbah-US Medical Campus II

Saudi-based Arbah Capital announces the acquisition of its second medical campus “Constitution Health Plaza”, an $87m high income producing diversified medical campus on Broad Street, South Philadelphia, United States, with prominent tenants such as City of Philadelphia health department, University of Pennsylvania medicine unit, Malvern Treatment Centers and Mercy Life providing a stabilized WALT of 16 years. This adds to Arbah’s $59m successful acquisition of Commonwealth Campus in Philadelphia in December 2020.

The medical sector has remained particularly resilient during the unfortunate Covid-19 pandemic and has proven to be a very defensive sector. This provides a certain degree of stability for the investment in an increasingly volatile economic climate. Arbah moved strategically into this sector and now has a portfolio of 4 investments totaling nearly $220m in the Health sector which include two Senior Living projects in Florida.

Arbah was able to secure the acquisition at a significant discount to the market valuation carried out by Cushman and Wakefield which will provide further security to our investors. Constitution Plaza has a prominent 3.4 acre site on Broad Street, South Philadelphia, just north of the CBD. Philadelphia is known as medical and education hub and it is estimated that 1/5 of all US physicians trained here.

Arbah is proud to partner again with Hampshire Stateside in this transaction. Hampshire Companies are an experienced real estate manager who manage more than 270 properties and have an AUM of over $2.4bn in the US. Arbah is very pleased to manage the portfolio with the same key partners allowing for stability and efficiency across the portfolio.

- Investment Budget $87 Million

- Closing Date: December 2021

- Target Cash Yield p.a.: 8.5%

- Target IRR 10%

- Expected Investment Period: 5 Years

Arbah-US Office I

Arbah-US Office I is a $59m acquisition of an income producing, Class-A office building in the growing market of Orlando, Florida, USA leased to Siemens Energy Inc on a long-term lease. Siemens Energy Inc is a subsidiary of Siemens Energy AG, an investment grade entity listed on the Frankfurt Stock Exchange. The asset is expected to yield 8.5% annually while Arbah’s projected investment strategy is to implement Asset Management strategies to enhance the value of the asset and exit towards the end of the holding period through 2026.

- Investment Budget: $59m

- Closing Date: 12 October 2021

- Target Cash Yield p.a.: 8.5%

- Target IRR: 10%

- Expected Investment Period: 5 Years

Arbah-US Senior Living II

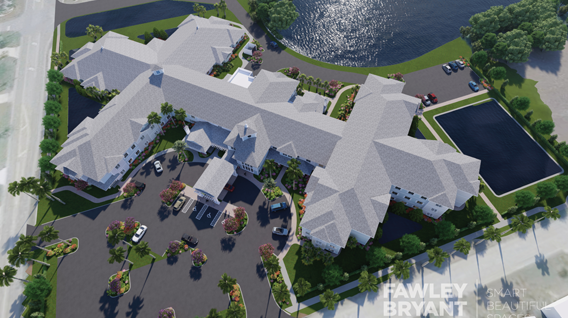

Arbah-US Senior Living II is Arbah’s second Shari’ah Compliant Senior Care development and operation opportunity with leading developers, Madison Marquette (“Madison”), and top-20 Senior Care Operator, Meridian Senior Living (“Meridian”). The project is located in Punta Gorda, Southwest of Florida, USA with a premier waterfront Class A facility with 127 units/135 beds of Assisted Living and Memory Care. The investment strategy is to develop, operate and provide the best community experience and facility, in an undersupplied sub-market with operations targeted to commence in 2023.

- Investment Budget: $38m

- Closing Date: 31 August 2021

- Target IRR: 15%

- Expected Investment Period: 4 Years

Arbah-US Medical Campus I

Saudi-based Arbah Capital announces the acquisition for its investors of the Commonwealth Campus, a $59m high income producing diversified medical campus in Port Richmond, Philadelphia, United States, with prominent tenants such as Ambrosia Treatment Centers Group, Temple Health University and Northeastern Partners.

Arbah is proud to partner with Hampshire Stateside in this transaction. Hampshire Companies are an experienced real estate manager who manage more than 270 properties and have an AUM of over $2.4bn in the US.

The medical sector has remained particularly resilient during the unfortunate Covid-19 pandemic and has proven to be a very defensive sector. This provides a certain degree of stability for the investment in an increasingly volatile economic climate. Arbah was able to secure the acquisition at a significant discount to the market valuation carried out by CBRE which will provide further security to our investors. Port Richmond, only a 15 minute drive from Downtown, as an area is seeing a process of gentrification, similar to what has happened in neighboring Fishtown, which provides a strong real estate based stimulus for future valuation growth. Philadelphia is known as medical and education hub and it is estimated that 1/5 of all US physicians trained here. The property itself has undergone more than $$23m in recent refurbishment including a brand new building on site which will open as a new outpatient facility for Ambrosia, and a wellbeing center which is due to open in January 2021.

- Investment Budget $59 Million

- Closing Date: 12/2020

- Target IRR 9%

- Expected Investment Period: 5+1 Years

Arbah-US Diversified Industrial I

Arbah capital announced the acquisition of diversified income-generating properties consisting of five real estate assets in the industrial sector in the United States of America, leased to several companies, including Tesla, AT&T and Walmart, in partnership with the Brennan Investment Group, a leading company specializing in the American industrial sector.

According to reports prepared by major market advisory firms, including CBRE and Jones Lang LaSalle JLL, the US industrial sector has maintained its strength during the unfortunate spread of the Covid-19 epidemic. Signs of rising prices have emerged due to expectations of rising demand in the US industrial sector, boosted by the appetite for online shopping, along with the need to reduce reliance on manufacturing abroad, especially in China.

- Investment Budget $43 Million

- Closing Date: 10/2020

- Target IRR 9.5%

- Expected Investment Period: 4 Years

Arbah - US Senior Living I

Arbah US Senior living is a Shari’ah Compliant Senior Care development and operation opportunity with a leading developer Madison Marquette (“Madison”), a Capital Guidance Company, and a specialized operator, Meridian Senior Living (“Meridian”). The project located 12 miles to the east of downtown Tampa in Brandon, Florida, United States is to develop a senior care facility and operate it until it arrives at its occupancy stabilization levels. The facility will feature a premier Class A Senior Living community with 136 units of senior housing comprising of Assisted Living 106 units/106 beds and Memory Care 30 units/38 beds. The Investment Strategy is to develop, operate and provide the best community experience and facility, in an undersupplied sub-market, at rates comparable to existing “older” facilities.

- Investment Budget $36 Million

- Closing Date: 28/2/2020

- Target IRR 15%

- Expected Investment Period: 4 Years

Arbah Sauchiehall, UK

Arbah Sauchiehall, Glasgow

Arbah Capital initiated exclusive real estate deals, encompassing project acquisitions and development. The real estate investment focus now has global exposure. A recently acquired iconic property, Sauchiehall Glasgow — worth £59.5 m — was a milestone achievement. The acquisition is in-line with the firm’s strategy of targeting quality assets to establish broad base of income yielding real estate assets. The Sauchiehall Building is the anchor building in Sauchiehall Street, Glasgow, UK. Sauchiehall Street forms part of the ‘Golden Z’ of the 3 most prime retail streets in Glasgow City Center, and has the largest footfall of 16 million p.a.

"A recently acquired iconic property, Sauchiehall Glasgow — worth £59.5m — was a milestone achievement."

IRR: 10.0% p.a.

Cash yield: 8.0% p.a.

* Quarterly distribution